Introduction

The Bitcoin halving 2024 event is a pivotal moment for the cryptocurrency community. As the fourth halving in Bitcoin’s history, it significantly impacts the mining industry, affecting hashrate trends, market dynamics, and future growth prospects.

This comprehensive report examines how the 2024 Bitcoin halving is shaping Bitcoin hashrate growth, exploring its implications for miners and stakeholders. By understanding these changes, industry participants can better navigate the evolving landscape and make informed decisions to maximize their success post-halving.

Hashrate Trends

Growth Patterns Leading Up to Q1-2024

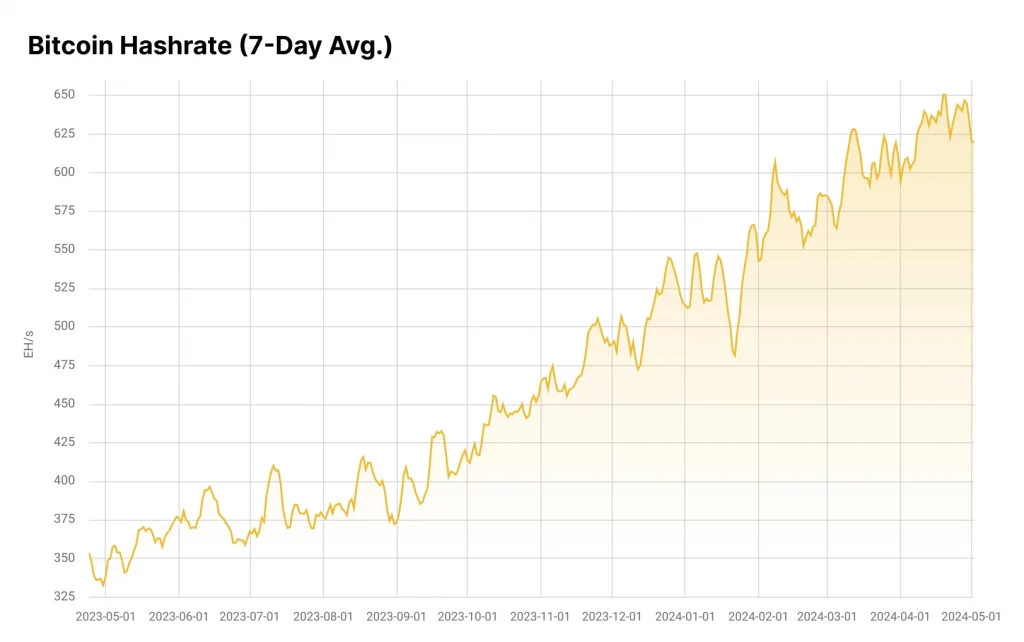

Before the 2024 Bitcoin halving, the Bitcoin network experienced significant hashrate growth. Miners anticipated the halving, investing heavily in new mining equipment and expanding their operations. This pre-halving period saw an influx of hashing power as miners sought to maximize their block rewards before the halving reduced them by half. The overall growth in hashrate indicated a robust and competitive mining environment, with many players vying to secure their share of the remaining Bitcoin rewards.

Impact of the Bitcoin Halving on Hashrate Growth

The 2024 Bitcoin halving event had a profound impact on hashrate growth. As the block rewards were halved from 6.25 BTC to 3.125 BTC, miners faced reduced revenue, prompting some to pause or shut down their operations temporarily. However, the more efficient miners with access to advanced equipment and cheaper energy sources continued to thrive. This led to a brief stabilization in hashrate growth immediately following the Bitcoin halving, followed by a resurgence as market conditions adjusted and new investments in mining infrastructure came online.

Projections for Future Hashrate Increases with New Equipment

Looking forward, the hashrate is expected to increase significantly as new mining equipment is deployed. Advances in ASIC technology and more efficient energy solutions are set to drive this growth. Manufacturers are rolling out next-generation mining rigs with higher hashing power and lower energy consumption, making it feasible for miners to operate profitably even with lower block rewards. Additionally, as the global market for Bitcoin matures, more institutional investments in mining infrastructure are likely, further bolstering hashrate growth.

Hashprice Volatility

Explanation of Hashprice and Its Significance

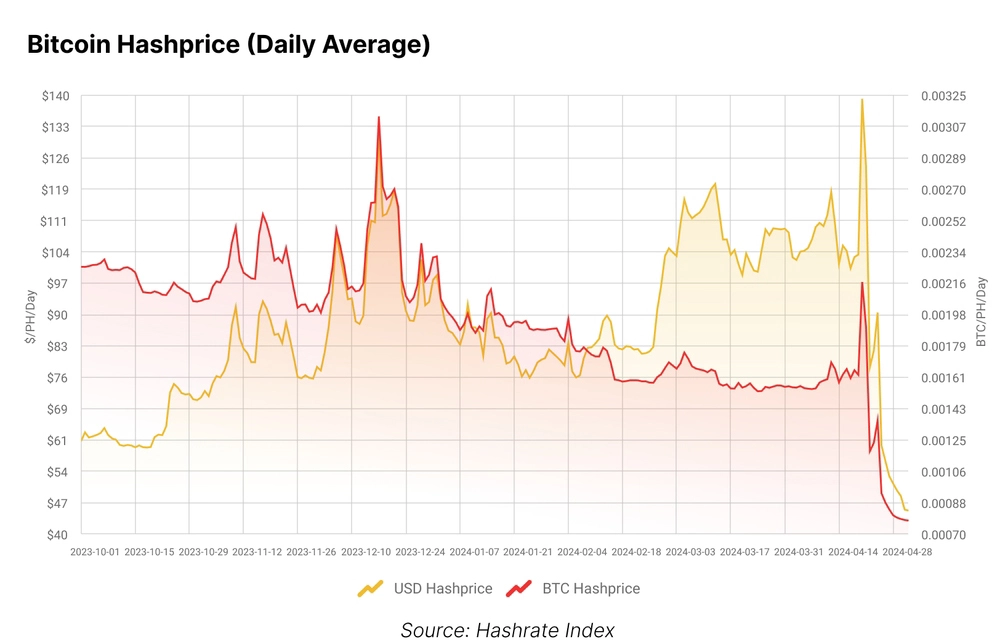

Hashprice is a crucial metric in the Bitcoin mining industry, representing the revenue miners earn per terahash (TH) of computing power per second. It directly affects miners’ profitability, influencing their operational decisions and long-term strategies. Understanding hashprice is essential for gauging the economic viability of mining operations, especially in the context of fluctuating Bitcoin prices and network difficulty.

Hashprice Trends Around the Halving Event

The 2024 Bitcoin halving event led to notable hashprice volatility. Initially, the reduced block reward caused a spike in hashprice due to increased transaction fees and miner competition. However, this was followed by a decline as the market adjusted to the new reward structure. The interplay between Bitcoin price movements and mining difficulty also contributed to hashprice fluctuations, creating a dynamic environment for miners.

Factors Contributing to Post-Halving Hashprice Fluctuations

Several factors contributed to the post-halving hashprice fluctuations. These include changes in Bitcoin’s market price, which directly impacts miners’ revenue. Additionally, variations in network difficulty, driven by the collective computational power of miners, influence hashprice. External factors such as regulatory developments, technological advancements in mining hardware, and shifts in energy costs also play significant roles in shaping hashprice dynamics.

How Runes Impacted Transaction Fees

Introduction of Runes

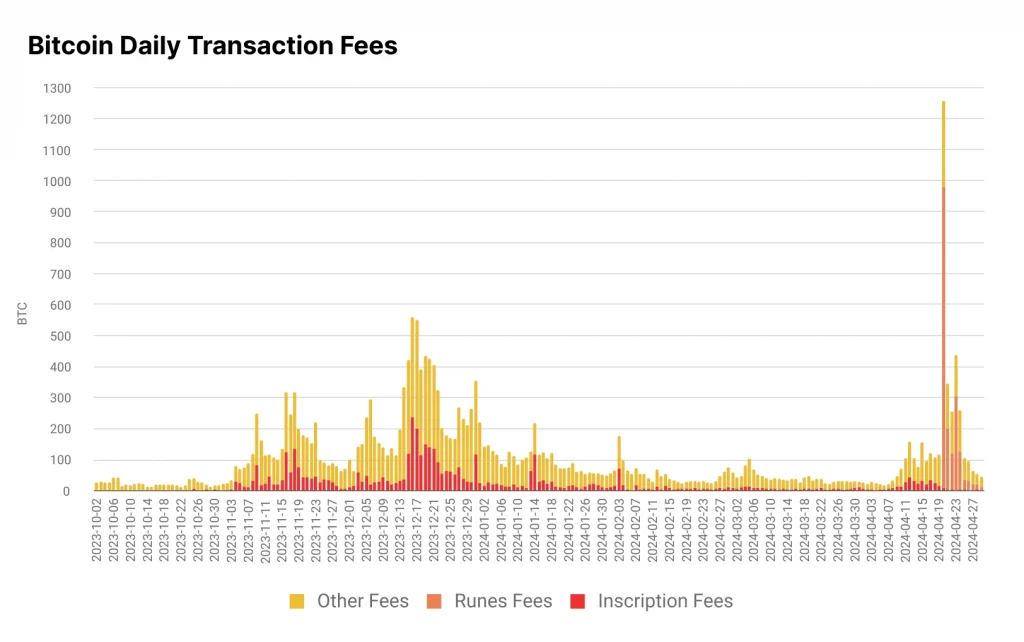

Runes, introduced in 2024, are a new transaction format designed to optimize Bitcoin transaction processing. They offer more compact and efficient transactions, which can fit more transactions into a single block compared to traditional formats.

Initial Impact on Transaction Fees

Initially, the introduction of Runes led to an increase in transaction fees. The higher demand for block space and the network’s adjustment to the new format contributed to this spike. This was particularly evident immediately following the 2024 Bitcoin halving, as miners adapted to the reduced block rewards and increased transaction volumes.

Long-term Effects on Transaction Fees

Over time, Runes are expected to stabilize and potentially lower transaction fees. Their efficient format reduces the overall data size of transactions, allowing for more transactions to be processed per block. This efficiency is especially beneficial as Bitcoin’s network grows and transaction volumes continue to rise.

ASIC Market Dynamics

Pre-Halving Slowdown in the ASIC Market

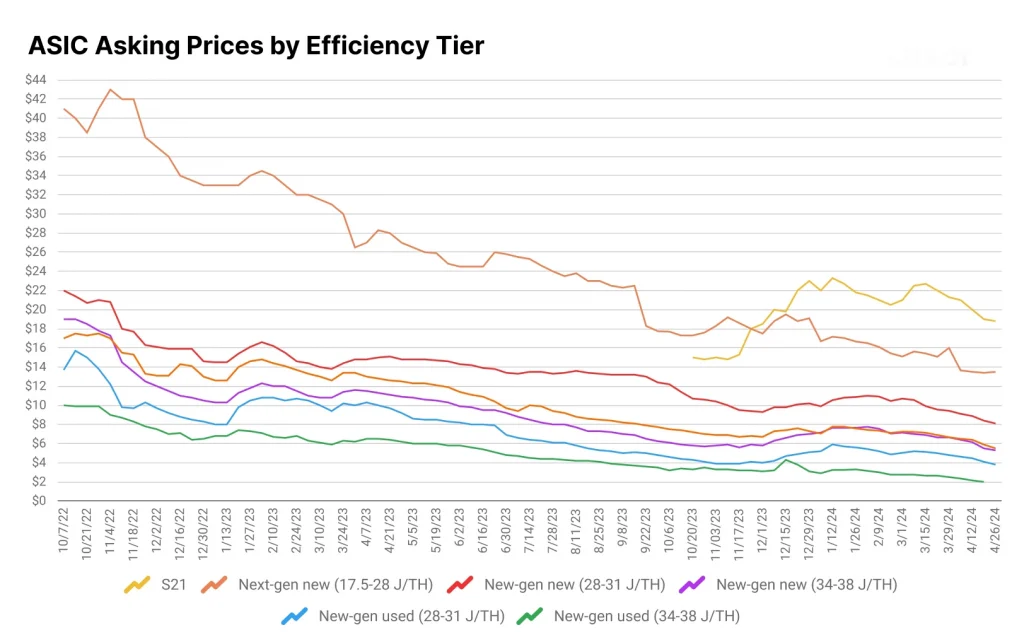

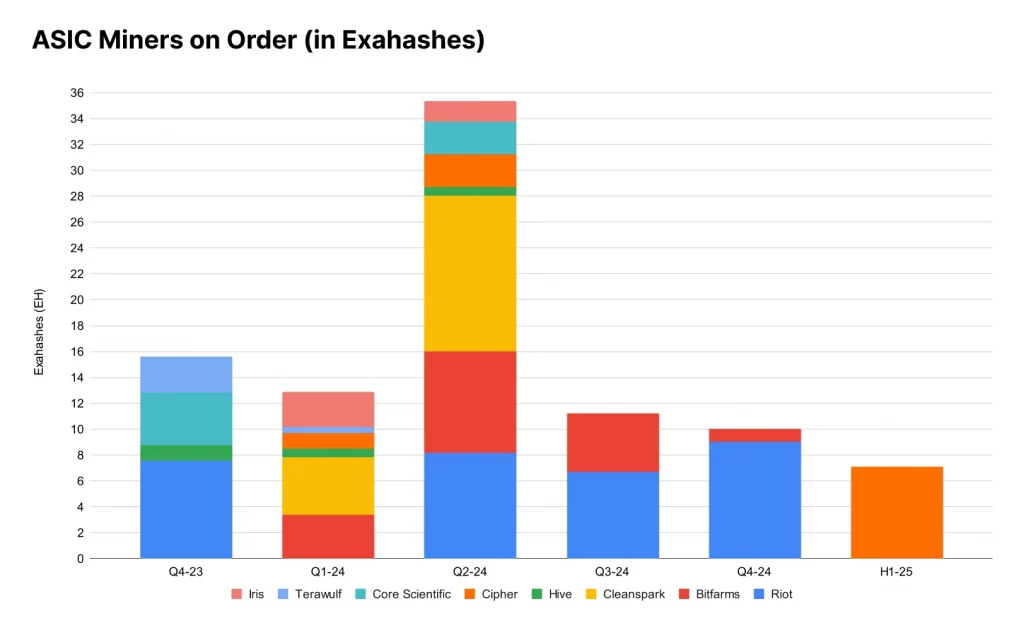

In the months leading up to the 2024 Bitcoin halving, the ASIC (Application-Specific Integrated Circuit) market experienced a notable slowdown. Many miners hesitated to make significant investments in new hardware due to the impending reduction in block rewards. This cautious approach was driven by uncertainty regarding the post-halving profitability of mining operations. As a result, there was a temporary decline in the demand for ASIC miners, with many industry players adopting a wait-and-see strategy.

Analysis of Current Market Trends and Key Players

Post-halving, the ASIC market began to show signs of recovery and transformation. Key players in the industry, such as Bitmain, MicroBT, and Canaan, continued to innovate, developing more efficient and powerful mining rigs. These advancements are critical for miners aiming to maintain profitability in a lower-reward environment. Additionally, there has been a shift towards consolidation in the market, with larger mining farms and institutional investors playing a more prominent role. This consolidation is expected to drive further advancements in ASIC technology and increase the overall efficiency of the mining sector.

Expected Developments and Innovations in ASIC Technology

Looking ahead, significant developments and innovations in ASIC technology are anticipated. Manufacturers are focusing on creating mining rigs with higher energy efficiency and greater computational power. Innovations such as immersion cooling and advanced chip designs are set to revolutionize the industry. These technological advancements will enable miners to reduce operational costs and improve their competitive edge. Furthermore, the integration of AI and machine learning in mining operations is expected to optimize performance and enhance profitability, ensuring that miners can thrive even as the block rewards continue to decrease.

Energy Competition

Increasing Competition for Power Resources

The energy demand for Bitcoin mining has surged, leading to intense competition for power resources. This is particularly pronounced in regions with low energy costs, where miners are vying for limited resources. The growing interest in renewable energy sources has added another layer of competition, as miners seek sustainable and cost-effective power solutions to ensure long-term profitability.

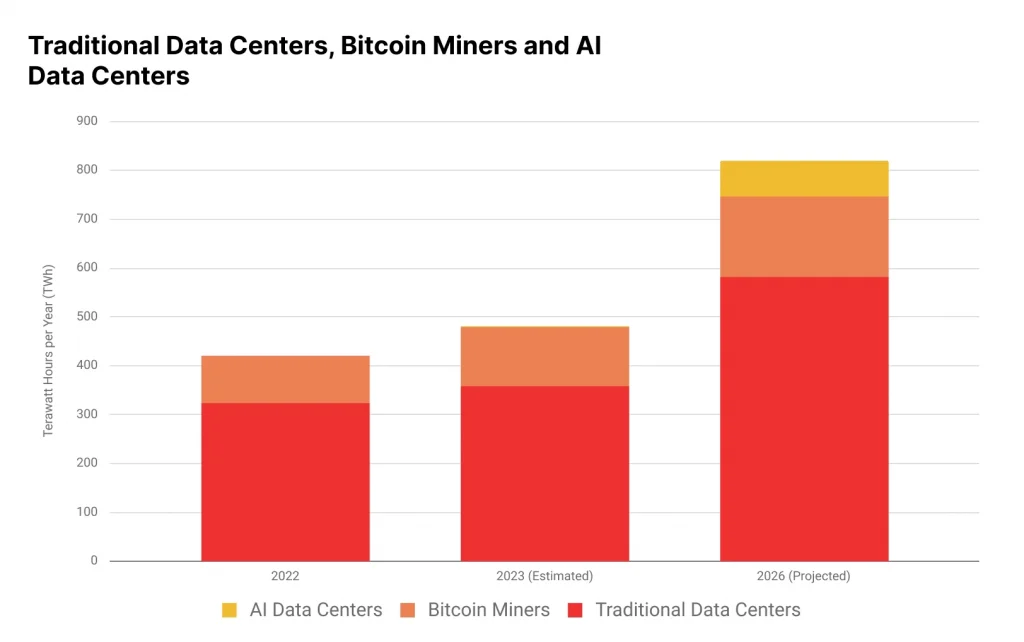

Comparison Between Bitcoin Miners and AI Data Centers

Bitcoin miners are not the only entities competing for energy. AI data centers, which also require substantial power for their operations, have emerged as significant competitors. Both industries are seeking access to affordable, reliable energy sources, driving up demand and prices in certain regions. This competition underscores the importance of energy efficiency and innovative solutions to reduce operational costs.

Strategies Miners Are Using to Secure Energy Resources

To secure energy resources, Bitcoin miners are employing several strategies. Many are investing in renewable energy projects, such as solar and wind farms, to gain access to sustainable and potentially cheaper power. Additionally, miners are exploring partnerships with energy providers to ensure a steady supply of electricity. Some are even relocating their operations to regions with abundant and low-cost energy, such as areas with surplus hydroelectric power. These strategies are crucial for maintaining profitability and staying competitive in the rapidly evolving mining landscape.

Future Growth Prospects

Short-term and Long-term Growth Forecasts

The short-term growth prospects for Bitcoin mining appear promising as miners adapt to the new reward structure post-halving. Increased investments in advanced mining equipment and strategic energy sourcing are expected to drive growth. In the long-term, continued innovation in mining technology and broader adoption of Bitcoin as an asset class will likely sustain growth. Institutional investors are increasingly entering the space, providing additional capital and stability to the mining industry.

Impact of New Equipment Deliveries on the Mining Landscape

The introduction of new, more efficient mining equipment is poised to significantly impact the mining landscape. These advancements will enable miners to maintain profitability despite reduced block rewards. The latest ASIC models boast higher computational power and improved energy efficiency, making them attractive investments for both new and existing mining operations. As these new machines are deployed, the overall hashrate is expected to increase, further securing the network and enhancing its robustness.

Potential Challenges and Opportunities for Miners

Despite the positive growth outlook, miners face several challenges. Energy costs remain a significant concern, and regulatory pressures in various regions could impact operations. Additionally, the environmental impact of Bitcoin mining continues to attract scrutiny, prompting the need for sustainable practices. However, these challenges also present opportunities. Miners who can innovate and adopt green energy solutions will not only reduce costs but also improve their public image. Furthermore, advancements in AI and machine learning offer potential for optimizing mining operations, increasing efficiency, and maximizing returns.

Conclusion

The 2024 Bitcoin halving has significantly impacted the mining industry, leading to changes in hashrate trends, hashprice volatility, ASIC market dynamics, and energy competition. By understanding these factors, miners and stakeholders can better navigate the evolving landscape.

Stakeholders must adapt to the new market conditions by investing in advanced mining equipment, exploring sustainable energy solutions, and staying informed about regulatory developments. These strategies will help ensure long-term profitability and competitiveness.

The future of Bitcoin mining post-2024 Bitcoin halving is filled with both challenges and opportunities. Continued innovation in mining technology and strategic adaptation to market changes will be crucial for success. As the industry evolves, miners who can leverage new technologies and sustainable practices will be best positioned to thrive.

FAQs

1. What is the Bitcoin halving and why is it significant?

The Bitcoin halving is an event that reduces the block reward miners receive by half. It occurs approximately every four years and impacts the supply of new bitcoins, influencing market dynamics and mining profitability.

2. How did the 2024 Bitcoin halving affect Bitcoin hashrate growth?

The 2024 Bitcoin halving initially led to a brief stabilization in hashrate growth due to reduced block rewards. However, the hashrate began to increase again as new, more efficient mining equipment was deployed.

3. What is hashprice and why is it important?

Hashprice measures the revenue miners earn per terahash of computing power per second. It is crucial for assessing miners’ profitability and influences their operational decisions.

4. How did the 2024 Bitcoin halving impact hashprice volatility?

The 2024 Bitcoin halving caused hashprice to spike initially due to increased transaction fees and miner competition, followed by a decline as the market adjusted to the new reward structure.

5. What were the pre-halving trends in the ASIC market?

Prior to the 2024 Bitcoin halving, the ASIC market saw a slowdown as miners hesitated to invest in new hardware due to uncertainty about post-halving profitability.

6. What are the key trends in the ASIC market post-halving?

Post-halving, the ASIC market showed recovery and transformation with advancements in mining technology and increased efficiency. Larger mining farms and institutional investors began playing a more significant role.

7. How are Bitcoin miners competing for energy resources?

Bitcoin miners face increasing competition for power resources, especially with AI data centers. They are adopting strategies like investing in renewable energy projects and forming partnerships with energy providers to secure power.

8. What is the expected impact of new mining equipment on the industry?

New mining equipment with higher computational power and improved energy efficiency is expected to drive hashrate growth and enhance profitability, despite the reduced block rewards.

9. What challenges do Bitcoin miners face post-2024 Bitcoin halving?

Miners face challenges such as high energy costs, regulatory pressures, and environmental concerns. Innovating with sustainable energy solutions and optimizing operations can help overcome these challenges.

10. What opportunities exist for Bitcoin miners after the 2024 Bitcoin halving?

Opportunities include leveraging advancements in mining technology, adopting green energy practices, and optimizing operations using AI and machine learning to increase efficiency and profitability.